In today’s fast-paced world, stable finances are crucial for many individuals. If you’re struggling with high-interest credit card debt, consider utilizing zero balance transfer credit card offers as a solution. These promotions allow you to transfer existing debt to a new card with a zero-interest period, aiding in debt management.

TOC

- 1. Importance of Selecting the Best Credit Card Offer

- 2. Recognizing Credit Cards with No Balance Transfers

- 3. Advantages of Credit Card Offers with No Balance Transfer

- 4. How to Locate the Best Credit Card Offers with No Balance Transfer

- 5. How to Apply for a Credit Card with No Balance Transfer

- 6. In summary

Importance of Selecting the Best Credit Card Offer

Imagining oneself burdened with mounting credit card debt due to accumulating interest charges can feel overwhelming, akin to being ensnared in quicksand. However, there is a solution—the right credit card offer could be your lifeline. By leveraging credit card offers without balance transfers, you can liberate yourself from the shackles of high interest rates and significantly progress towards debt repayment.

The advantages of credit cards with no balance transfers:

Imagine being able to pay off your debt without having to worry about accruing interest, which would impede your progress. This dream comes true with credit cards that offer 0% balance transfers. You can potentially pay off your debt more quickly and save a significant amount of money on interest by moving your current debt to a credit card with a 0% interest rate.

That’s not all, though. Savings on interest are not the only benefit of these credit cards. They also offer a practical means of debt consolidation, which simplifies financial management. Your financial life can be made simpler by consolidating your debt into a single monthly payment rather than juggling several payments and due dates.

Furthermore, using credit cards with no balance transfers responsibly can raise your credit score. You can gradually improve your creditworthiness by lowering your total debt and demonstrating to creditors that you are a responsible financial citizen by making on-time payments.

We will go into more detail about 0 balance transfer credit cards and their benefits in the following section. So fasten your seatbelts and get ready to set out on a quest for financial independence!

“Are you sick and weary of being in debt from credit cards? Experience the power of credit card offers with no balance transfers to free yourself from the shackles of exorbitant interest rates. Together, let’s examine the advantages!”

Recognizing Credit Cards with No Balance Transfers

A. What Zero Balance Transfer Credit Cards Are and Why They Are Used

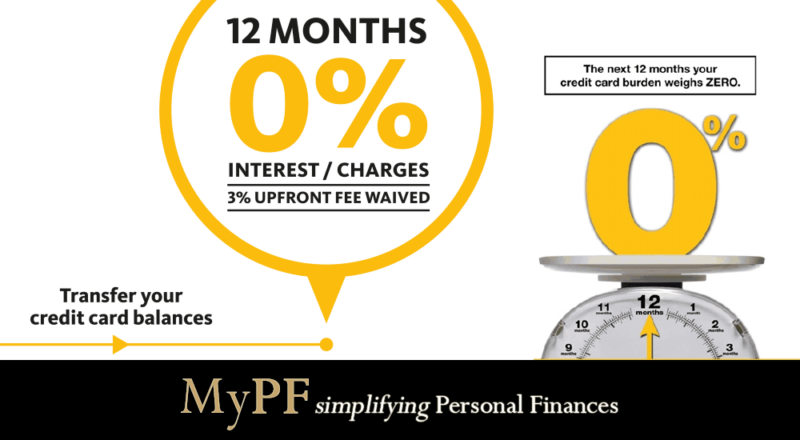

Explaining the concept of credit cards with zero balance transfers. These financial tools allow transferring credit card debt to a new card with 0% interest for a set period. This move helps shift debt from high-interest cards to a more affordable option. Zero balance transfer credit cards provide a temporary break from interest payments. By eliminating or reducing interest rates on transferred balances, you can focus on repaying the principal amount, accelerating your path to debt freedom.

B. The Benefits and How These Cards Operate

Now that we are clear on the fundamentals of 0 balance transfer credit cards, let’s examine their features and benefits. You will be able to move over your current credit card debt to the new card if you are accepted for a credit card with a zero balance transfer option. During this process, the outstanding balance on your old card(s) is transferred to the new card, usually with a small transfer fee.

After the transfer is finished, there will be a grace period, usually for a predetermined amount of time, during which the transferred balance will not accrue any interest. This time frame can vary based on the particular credit card offer, from a few months to a year. It’s vital to remember that any additional purchases made with the credit card with a 0 balance transfer could result in interest at the standard rate, so it’s best to pay off the transferred balance first.

Credit cards with no balance transfers have many benefits. First off, your financial situation may be greatly impacted by your capacity to reduce interest payments. You can significantly reduce your debt by directing those funds toward paying off your principal balance.

Second, managing your finances is made easier when all of your debt is consolidated onto one card. You will only have one monthly payment to remember rather than coordinating several creditors and due dates, which will simplify your tasks and lower the possibility of missing payments.

C. Things to Think About Prior to Applying for a Credit Card with No Balance Transfer

It is important to take into account a few factors that may influence your decision-making process before delving into the world of credit cards with no balance transfers. First of all, pay attention to the card’s transfer fee. Certain cards may impose a fee that is calculated as a percentage of the transferred balance, even though the interest savings can be substantial. To make sure this fee is in line with your financial objectives, it is crucial to compare it to possible interest savings.

Don’t forget to consider how long the 0% interest period lasts. A longer period gives you more time to pay off your debt interest-free. Take into account your ability to make repayments and select a card that offers a reasonable repayment period for your situation.

Finally, remember that after the promotional period expires, the annual percentage rate (APR) will continue to apply. It’s critical to comprehend the regular interest rate if you expect to carry a balance after the interest-free period to make sure it fits into your budget.

You can choose the best credit card for 0 balance transfers by taking these things into account and making an informed choice. We will go into greater detail about the advantages of these offers in the following section, including how they can help with debt management and possibly save money.

“Take charge of your debt journey by learning the secrets of credit cards with zero balance transfers. Learn about the benefits of these cards, how they operate, and what to think about before applying. Together, let’s clear the path to a future free of debt!”

Advantages of Credit Card Offers with No Balance Transfer

Reduced borrowing costs and possible savings

One of the most alluring features of credit card offers with no balance transfer is the chance to take advantage of reduced interest rates. These cards, as their name implies, let you move over your current credit card debt to a new card that has an introductory APR (Annual Percentage Rate) of 0% for a predetermined amount of time. This implies that there won’t be any interest charged to the transferred balance during the introductory period.

You can save a substantial sum of money on interest by taking advantage of this promotional period. If you were no longer paying interest rates of 20% or higher each month, just think of the savings you could make. It’s similar to putting money back in your pocket and hastening the process of becoming debt-free.

Effective debt consolidation and payment management

The option to combine all of your debt into a single payment is another important advantage of credit cards with zero balance transfers. By consolidating all of your credit card balances onto a single card, you can simplify your financial management and eliminate the hassle of managing numerous bills with disparate deadlines. This streamlines your payments, facilitating better debt management and tracking.

Not only does consolidation spare you the headache of having to keep track of numerous deadlines, but it may also enable you to bargain for more favorable terms of repayment. One payment gives you a better understanding of your total debt, which helps you plan and manage your resources more wisely.

Increasing credit scores through prudent credit card use

Unbeknownst to you, credit cards with no balance transfers can also raise your credit score. Transferring balances to a new credit card demonstrates responsible credit usage and may enhance your creditworthiness. Lessening your credit utilization ratio tells lenders that you are a responsible borrower by showing them how much of your available credit you are actually using.

Additionally, as you pay your bills on time and lower your total debt, your credit score might progressively rise. This is due to the fact that two important variables that affect your credit score are your payment history and credit utilization. Thus, you may improve your creditworthiness by using your credit card with no balance transfer wisely and by making wise financial choices.

After discussing the advantages of credit card offers with no balance transfers, let’s move on to the next section where we offer helpful advice to assist you in locating the best deals. Your journey to financial independence is just getting started, so stay tuned!

The benefits of 0 balance transfer credit card offers are threefold: reduced interest rates, easier payments, and enhanced credit scores. Find out how these benefits can change the way you approach money!”

How to Locate the Best Credit Card Offers with No Balance Transfer

A little research can go a long way toward locating the best credit card offers with no balance transfer. Here are some crucial pointers to help you sort through the available choices and select the ideal card for your requirements.

Exploring and comparing different credit card options

It is essential to conduct thorough research before accepting any credit card offer. Prioritize evaluating various credit card companies and their offerings. Look for reputable institutions known for delivering exceptional customer service and competitive pricing.

Subsequently, compare the features and benefits of multiple credit cards that permit balance transfers to zero. Consider factors such as the introductory period’s length, the ongoing annual percentage rate, and associated fees. Be attentive to supplementary perks that align with your financial plan, such as cashback incentives or rewards schemes.

Understanding Balance Transfer Terms and Conditions

Even though 0% interest rates can be alluring, it’s important to comprehend the terms and conditions of balance transfers. Make sure you understand the conditions and restrictions of the offer by taking the time to read the fine print.

Among the crucial information to take into account is the balance transfer fee, which is usually calculated as a percentage of the transferred amount. Furthermore, take note of any limitations on the kinds of debts that qualify for transfer. You can avoid unpleasant surprises later on and make an informed decision by being aware of these terms.

C. assessing the costs, trial periods, and ongoing APRs

When comparing credit card offers without balance transfers, it’s crucial to factor in costs, introductory periods, and ongoing APRs. While a longer trial period may seem enticing, other aspects require consideration.

Remember to include the balance transfer fee and any annual or additional charges associated with the card. Post the introductory period, an ongoing APR will apply. Opt for a credit card with a competitive ongoing APR for long-term savings.

By conducting thorough research, understanding the terms, and evaluating fees and APRs, confidently select the ideal credit card offer without balance transfer suited to your needs.

Don’t settle for the first 0 balance transfer offer. Uncover hidden advantages and choose a card within your budget using these tips. Let’s explore the details together!

How to Apply for a Credit Card with No Balance Transfer

Collect the Information and Documents Required

To ensure a smooth and efficient application process, it is essential to gather all necessary documentation and information before commencing. To enhance your chances of approval, the following are typically required:

1. Proof of Identification: Prepare a valid government-issued identification document such as a passport or driver’s license to verify your identity.

2. Income Verification: Lenders require evidence of your ability to repay the loan. Collect recent tax returns, bank statements, and pay stubs to demonstrate your stable income.

3. Credit History Review: Familiarize yourself with your credit score, outstanding debts, and current credit cards. This information aids lenders in assessing your creditworthiness and determining the maximum credit limit.

4. Current Credit Card Statements: Keep your latest statements accessible for accurate data input if you plan to transfer your balance from another credit card during the application process.

A Guide to the Application Process Step-by-Step

Now that your documentation is in order, let’s review the step-by-step process for applying for a credit card with no balance transfer:

1. Research and compare offers: Initiate by evaluating the 0 balance transfer offers from different credit card providers. Scrutinize factors like initial interest rates, ongoing APRs, and associated fees.

2. Select the optimal credit card: Determine the credit card that aligns best with your requirements and financial goals. Consider aspects such as the promotional period’s duration, the post-promotional period interest rate, and any additional card benefits.

3. Access the online application form on the issuer’s website after finalizing your choice of credit card.

4. Complete the application: Furnish all requested details and ensure the application form is accurately filled out. Thoroughly review the application for any errors before submission.

5. Submit necessary documents: If required, submit or upload the relevant supporting documents for identity, income, and credit history verification.

6. Await approval: Upon application submission, the credit card issuer will assess your information. The approval process may take from a few days to a few weeks. Your patience during this period is appreciated.

Advice for Raising Your Chances of Approval and Preventing Typical Errors

Remember the following recommendations to enhance your likelihood of approval while steering clear of potential pitfalls:

– Maintain a high credit score: Credit card offers without balance transfers are more likely to be extended to individuals with higher scores. Ensure a low credit utilization, timely bill payments, and avoid opening multiple credit accounts simultaneously.

– Scrutinize the details: Review the terms and conditions of credit card offers carefully, paying attention to fees, balance transfer limitations, and promotional rate expiry dates.

– Avoid unnecessary credit inquiries: Rapidly applying for multiple credit cards can negatively impact your credit score. Only apply for cards if you meet the criteria and genuinely require them.

– Be honest and precise: Provide accurate information on your application. Inaccuracies or inconsistencies could lead to rejection and potential legal consequences.

Following these guidelines will prepare you to apply for a credit card without balance transfer, increasing your chances of approval. Organize your documents, select the suitable credit card, and embark on the journey towards financial independence.

Ready to manage your credit card debt effectively? Let’s delve into a step-by-step guide on applying for a credit card without balance transfer. I can assist you with everything from gathering necessary documents to avoiding common mistakes.

In summary

To effectively manage your credit card debt, leveraging 0 balance transfer credit card offers can be truly impactful. By capitalizing on these promotions, you can reduce interest expenses, consolidate debt, and progress towards financial autonomy.

Before committing to a credit card offer with a 0 balance transfer, it’s crucial to conduct comprehensive research. Compare various options, considering costs, promotional terms, and ongoing annual percentage rates. Understanding the terms and conditions of balance transfers is key to making informed choices and avoiding unwelcome surprises down the line.

Securing a credit card with no balance transfer is straightforward. Gather the necessary documentation, follow application instructions diligently, and demonstrate your creditworthiness to enhance approval odds. By steering clear of common pitfalls and setting the stage for a successful application, you pave the way for financial progress.

We are dedicated to equipping individuals with the means to manage their finances effectively. With 0 balance transfer credit card offers, you can break free from high-interest debt cycles and embark on a brighter financial future. Remember, maximizing these benefits and enhancing your credit score hinge on responsible utilization.

Why wait any longer? Explore the realm of credit cards featuring no balance transfers and embark on the journey towards financial independence. By taking action now, you unlock the potential to save money, eliminate debt, and establish a solid financial footing. Count on erp.ebest.vn to guide you every step of the way.